The Ultimate Guide to Transfer Pricing Methods for Business Success

Unlock the secrets of transfer pricing and navigate global taxation with confidence. . . .Jun 27, 2023

Read More

Contact us

For all the business substance framed in India according to the Companies Act, there are different ROC compliances which are required by the law to consent to auspicious. These consistencies are anything but difficult to keep up and have the least risk for proprietors, in the event that they are being consented appropriately and auspicious. The article here tosses spotlight on the Online ROC Annual Filling Compliances.

ROC Annual Filling Compliances incorporate documenting of structures with the recorder of organizations inside the stipulated time span as expressed in the standards. The ROC Annual Filling consistency process is very consistent given you get the correct assistance. These compliances are yearly announcing, which are required by the concerned laws so as to stay legitimate and verify.

The Registrar of Companies (ROC) falls under the Ministry of Corporate Affairs and it is the primary authority assigned to manage the organization of Companies Act 2013. Every organization fused under the Companies Act, 2013 should obligatorily record structures, returns, and reports with the Registrar of Companies (ROC). The recording is handled in an electronic mode inside a particular time alongside a recommended expense.

All organizations fused in India are required to record certain reports/data with the Registrar of Companies (ROC) every financial year. Enlistment center of Companies (ROC) is the assigned power that manages the organization of Companies Act 2013 and it falls under the Ministry of Corporate Affairs.

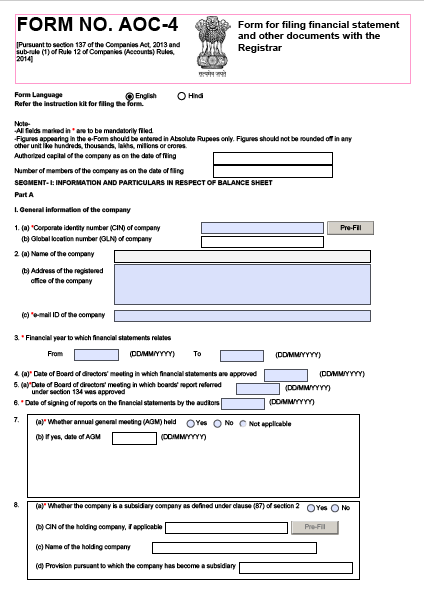

According to Companies Act, 2013, the managing law for organizations orders for each organization to document their Balance Sheet and Profit and Loss Account alongside the review report within 30 days from the Annual General meeting on structure ROC form AOC-4.

The organization is additionally required to document annual return containing data, for example, the name of the organization, its enlisted office, its vital business exercises, capital in the organization, subtleties of the considerable number of chiefs and investors and so on as on the date of Annual General Meeting inside 60 days from the date of Annual General Meeting in ROC Form MGT-7.

Blogs

In today’s business environment, the world demands quality professional services that are provided in a timely and cost-effective manner. We, at Manish Anil Gupta & Co, believe in putting our client’s needs squarely in front at all times.

"Need to know more about our services or what we do? Drop us your contact details and one of our professionals will call you to answer your query!"

0 Comment